Medicare Advantage Agent Can Be Fun For Anyone

An external review is executed by an outside evaluation organization gotten by the Massachusetts Office of Patient Security. You must request an outside appeal from the Massachusetts Office of Client Security within 4 months of getting the decision on your inner appeal. Your inner allure notice must offer the form to request an exterior evaluation and various other info regarding asking for an exterior testimonial.

Wellness insurance policy consistently places as one of the most vital benefits among workers and task applicants alike. Providing a group health insurance plan can help you keep an affordable benefit over various other employers specifically in a tight job market. When workers are stressed over how they're going to take care of a clinical problem or spend for it - they can end up being stressed out and distracted at the office.

It additionally supplies them comfort understanding they can pay for care if and when they need it. Medicare Advantage Agent. The choice to supply employee health benefits commonly boils down to an issue of price. Several tiny service proprietors ignore that the premium the amount paid to the insurance provider each month for protection is typically shared by the company and staff members

Medicare Advantage Agent - An Overview

These alternatives can include medical, dental, vision, and much more. To be qualified to enlist in health coverage via the Industry, you: Under the Affordable Treatment Act (ACA), you have special client protection when you are insured through the Health and wellness Insurance Policy Industry: Insurance companies can not reject coverage based on sex or a pre-existing problem.

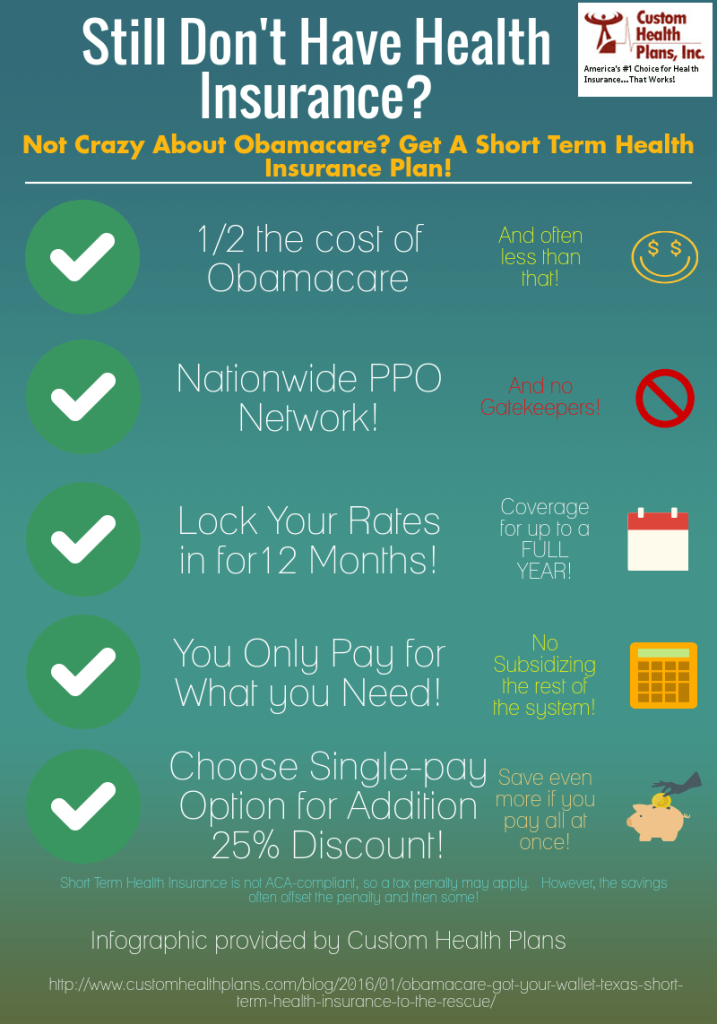

No person intends to obtain actually unwell or pain. When it takes place to you or your family members, it can set you back a great deal of cash to obtain treatment. Medical insurance can secure you from these high costs. If you purchase health and wellness insurance, it can quickly cost you much less money than going to the healthcare facility without it.

Health insurance policy still costs money and picking the right policy for you can be difficult. Medicare Advantage Agent. What if you already have insurance?

Discover regarding the kinds of advantages to anticipate when you have health insurance. Learn a lot more about the expense of health insurance coverage including things like co-pays, co-insurance, deductibles, and premiums.

Some Of Medicare Advantage Agent

It will certainly sum up the essential functions of the strategy or insurance coverage, such as the covered advantages, cost-sharing provisions, and insurance coverage constraints and exemptions. Individuals will certainly receive the recap when looking for coverage, registering in protection, at each brand-new plan year, and within 7 business days of asking for a copy from their medical insurance company or group health insurance plan.

Many thanks to the Affordable Treatment Act, customers will certainly likewise have a brand-new source to aid them comprehend some of the most common however complex jargon used in medical insurance (Medicare Advantage Agent). Insurance provider and group wellness plans will be required to provide upon demand an uniform reference of terms generally utilized in medical insurance protection such as "deductible" and "co-payment"

Wellness insurance coverage in the united state can be confusing. Many individuals do not have accessibility to excellent insurance coverage they can manage, and millions of individuals don't have any kind of medical insurance in all. There are lots of broad view changes that the federal government needs to make so that medical insurance functions much better.

The 10-Minute Rule for Medicare Advantage Agent

"Often insurance policy companies likewise make adjustments to advantages in terms that are usually relevant upon have a peek at this site revival of the policy, therefore you want to ensure that you're examining those and you recognize what those modifications are and how they may affect you," Carter states. It's additionally worth inspecting your benefits if your health and wellness has actually changed recently.

"If consumers can just make the review of their medical insurance policy a typical Web Site technique, it's something that becomes less complicated and simpler to do gradually," says Carter. Just how much you utilize your health and wellness insurance depends upon what's going on with your health. An annual physical with your key treatment medical professional can maintain you updated with what's going on in your body, and provide you an idea of what kind of wellness care you could require in the coming year.